International Edition

Simmons cashes in on £420m finance merger

International Edition

Olswang and A&O lead on £375m RoadChef acquisition

International Edition

Eversheds advises Brum developer on £500m planning application

International Edition

Trowers rings up $3.8bn Kuwaiti mobile deal

International Edition

International Edition

Deals: Capital Markets 15/03/2007

International Edition

Legal Week

CC bags KKR mandate on Alliance Boots bid

International Edition

CC bags KKR mandate on Alliance Boots bid

International Edition

A&O Amsterdam lands €11bn pharma deal

TRENDING STORIES

- Are Law Firms Keeping Pace With Their Clients Business?

- ALM Market Analysis Report Series: Boston's Legal Market is in Growth Mode and Big Law Knows It

- Stay vs Go: The Heightened Competition for Law Firm Office Space in Dallas

- Law.com Compass: Uncovering Lessons from Mid-Market Firm Segment Comparisons

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250

More from ALM

- Morgan & Morgan Class Action Attorneys Detail Pathway to Success Within Cybersecurity and Data Privacy Practice 1 minute read

- Holwell Shuster & Goldberg Partners Leverage 'Hostile' Witnesses to Secure $101 Million Verdict Against Walmart 1 minute read

- Legal Speak at General Counsel Conference Midwest 2024: Mike Andolina, Partner, White & Case 1 minute read

Resources

Strong & Hanni Solves Storage Woes--Learn How You Can, Too

Brought to you by Filevine

Download Now

Meeting the Requirements of California's SB 553: Workplace Violence Prevention

Brought to you by NAVEX Global

Download Now

The Benefits of Outsourcing Beneficial Ownership Information Filing

Brought to you by Wolters Kluwer

Download Now

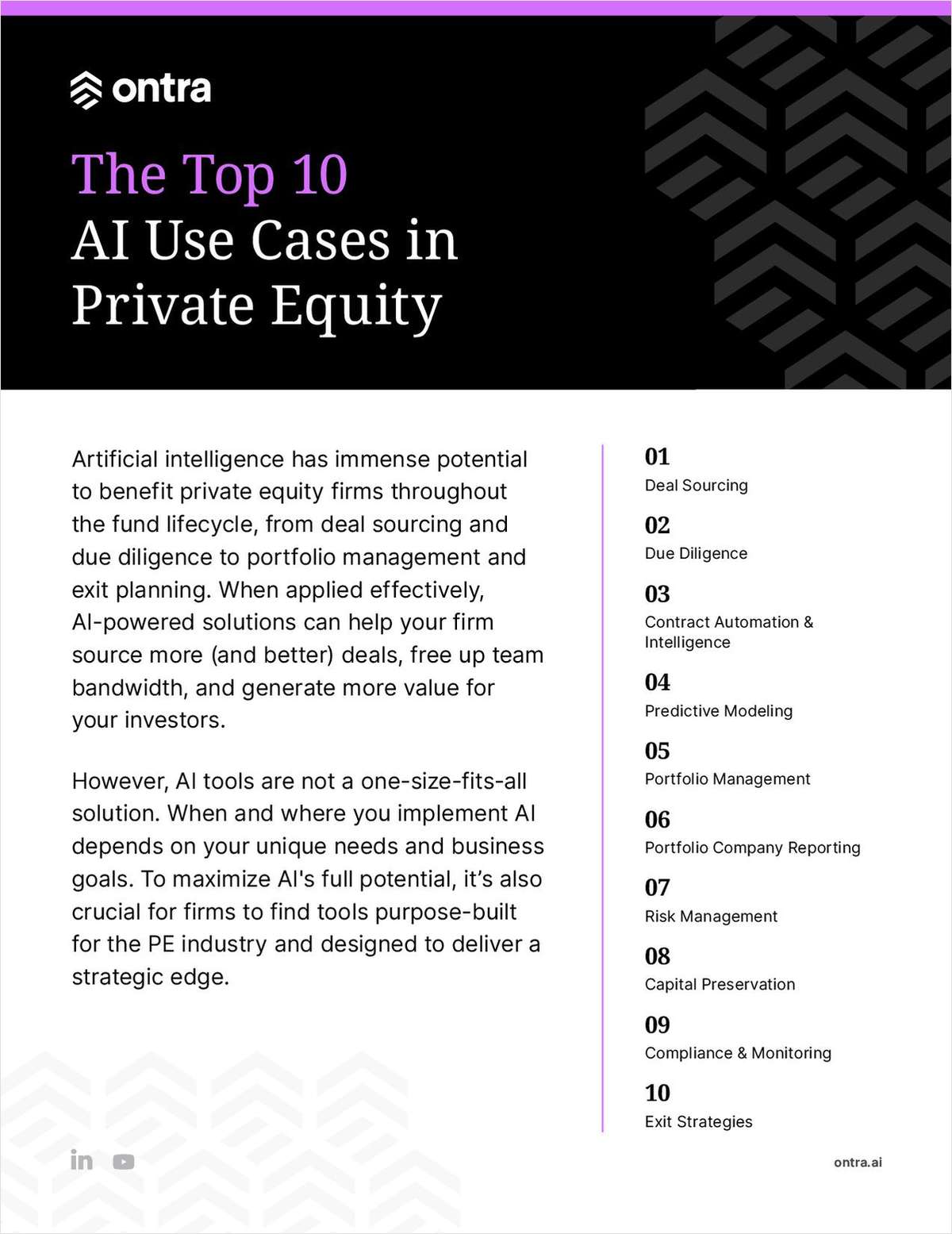

The Top 10 AI Use Cases in Private Equity

Brought to you by Ontra

Download Now