International Edition

Four firms score lead roles on latest Portsmouth FC buyout

International Edition

Orrick and Taylor Wessing sign up Clifford Chance partner trio

International Edition

Freshfields, Cleary and Salans head up $1.6bn Russian energy deal

International Edition

Freshfields and Bakers advise long-term clients on $7.1bn pharma buyout

International Edition

Simpson Thacher and Cravath head up $6.4bn Xerox acquisition

International Edition

Slaughters and Freshfields lead on Unilever's €1.3bn Sara Lee bid

International Edition

Linklaters leads for Rio Tinto on asset disposal deal double

International Edition

EDF concludes legal restructuring after British Energy buyout

International Edition

Freshfields eclipses rivals in German M&A rankings

International Edition

CC and Weil Gotshal land roles on $2.6bn Orangina Schweppes bid

TRENDING STORIES

- Are Law Firms Keeping Pace With Their Clients Business?

- ALM Market Analysis Report Series: Boston's Legal Market is in Growth Mode and Big Law Knows It

- Stay vs Go: The Heightened Competition for Law Firm Office Space in Dallas

- Law.com Compass: Uncovering Lessons from Mid-Market Firm Segment Comparisons

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250

More from ALM

- Morgan & Morgan Class Action Attorneys Detail Pathway to Success Within Cybersecurity and Data Privacy Practice 1 minute read

- Holwell Shuster & Goldberg Partners Leverage 'Hostile' Witnesses to Secure $101 Million Verdict Against Walmart 1 minute read

- Legal Speak at General Counsel Conference Midwest 2024: Mike Andolina, Partner, White & Case 1 minute read

Resources

Strong & Hanni Solves Storage Woes--Learn How You Can, Too

Brought to you by Filevine

Download Now

Meeting the Requirements of California's SB 553: Workplace Violence Prevention

Brought to you by NAVEX Global

Download Now

The Benefits of Outsourcing Beneficial Ownership Information Filing

Brought to you by Wolters Kluwer

Download Now

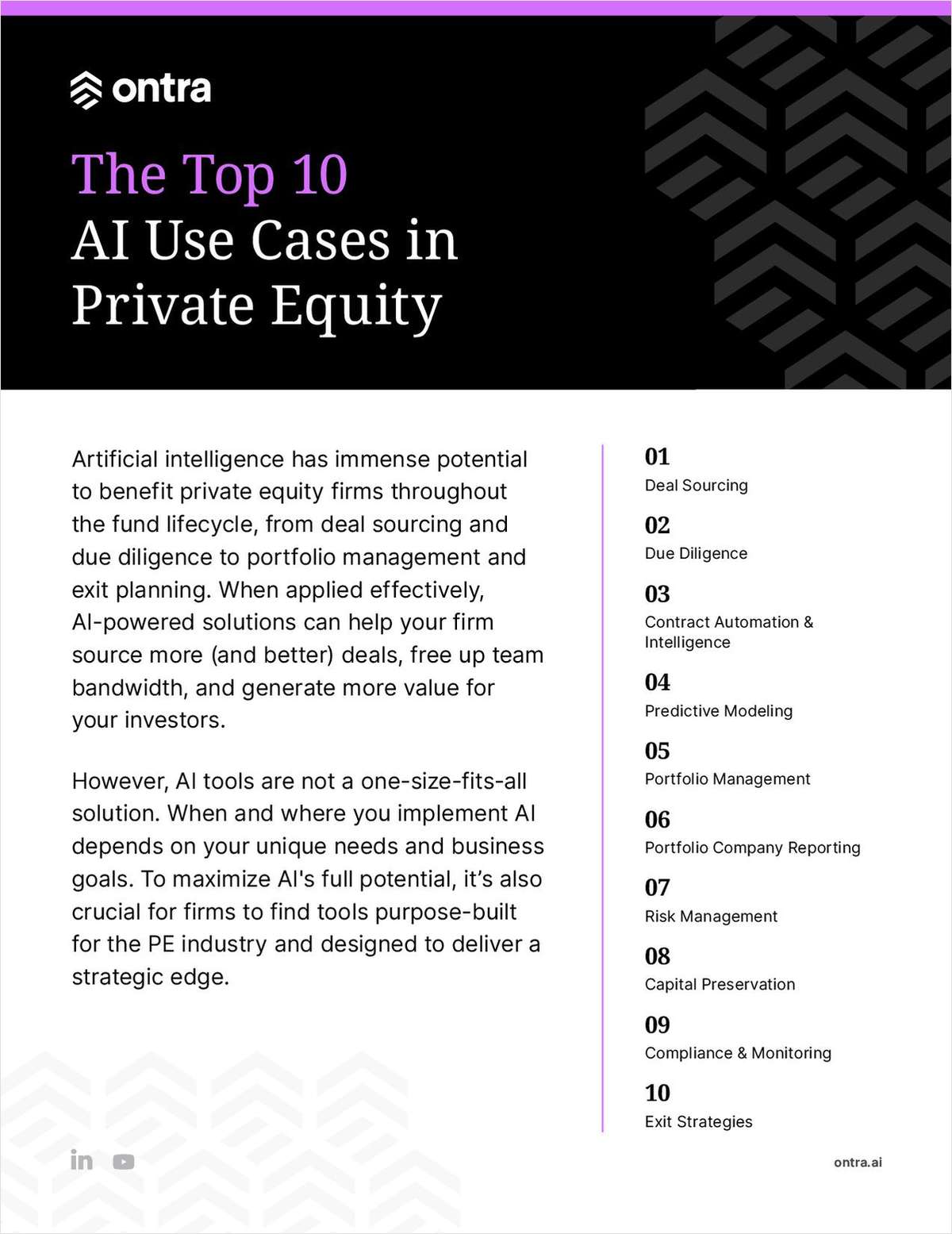

The Top 10 AI Use Cases in Private Equity

Brought to you by Ontra

Download Now