Judge to SEC: You Haven't Shown This ICO Is a Security Offering

U.S District Judge Gonzalo P. Curiel on Tuesday found that the SEC couldn't show that investors had bought into the Blockvest ICO with an expectation of making a profit from the efforts of others.

November 27, 2018 at 06:51 PM

4 minute read

The original version of this story was published on The Recorder

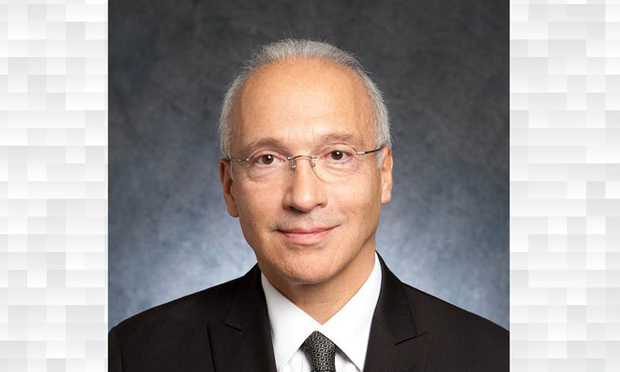

U.S. District Judge Gonzalo Curiel.

U.S. District Judge Gonzalo Curiel.

In what appears to be the first federal decision finding that the U.S. Securities and Exchange Commission hasn't shown a digital asset offered in an initial coin offering is a security, a judge in San Diego has turned back a request from the SEC for a preliminary injunction against the backers of the Blockvest ICO.

U.S District Judge Gonzalo Curiel of the Southern District of California, who previously granted the SEC's ex parte request for a temporary restraining order and froze the assets involved in the ICO, found Tuesday that the SEC couldn't show that investors bought into the Blockvest offering with the expectation of making a profit from the efforts as others—part of the three-part “Howey” test for the definition of a security under the the 1946 U.S. Supreme Court decision in SEC v. W.J. Howey Co.

SEC representatives didn't immediately respond to a request for comment on the decision. But former SEC lawyers now in private practice said that the case sends a message to the agency that courts are paying close attention to the question of whether digital tokens fit the legal definition of a security—even in cases where there are allegations that ICO investors are being defrauded.

“It is only through these sorts of decisions that we will learn the limits of the SEC's jurisdiction,” said Paul Hastings' Nick Morgan, who was previously senior trial counsel at the SEC. “The SEC should not assume that the courts are going to skate over whether or not there is a security present.”

In its complaint, the SEC alleged that Blockvest and its founder, Reginald Buddy Ringgold III falsely claimed its ICO was “licensed and regulated” by various agencies, including the SEC. The agency also claimed Ringgold promoted the ICO on the internet by saying it had gotten sign off from a fake agency called the “Blockchain Exchange Commission.” The SEC alleged Ringgold used a logo similar to the SEC seal and the same address as SEC headquarters for the faux agency.

But in defending against the SEC preliminary injunction request, Blockvest contended its initial offering involved just 32 testers who put a total of less than $10,000 worth of Bitcoin and Ethereum onto the Blockvest Exchange. Its BLV tokens, they claim, were only designed for testing the companies platform. Although the SEC had shown that some of the venture's backers had written “Blockvest” or “coins” on their checks to the company, Curiel found that the SEC couldn't show that the test investors expected to profit.

“Merely writing “Blockvest” or “coins” on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments,” Curiel wrote.

Stanley Morris of Santa Monica's Corrigan & Morris, who represents Blockvest and Ringgold, said it was obvious that the judge had studied the facts and the applicable precedent.

“It is an extraordinary challenge for defendants facing freeze orders and restraining orders obtained ex parte by the government,” Morris said. “They face a mountain of expedited discovery ordered by the court, with no money to pay professionals to respond.” Morris said his client's “met that challenge through aggressive defense and proactive presentations of evidence.”

“Relieved of the constraints of the TRO, our clients are now free to defend themselves through trial and look forward to being vindicated,” he said.

Fenwick & West's Mike Dicke, who was previously the top enforcement lawyer in the SEC's San Francisco regional office, said that the case demonstrated that question of whether or not an individual ICO is a security or not will depend on how its “offered and sold.”

“Is this digital asset a security? That's not the right question to ask,” he said. “I think that my biggest takeaway from the order is that the SEC failed to prove that the way it was 'offered and sold' meets the definition of a security.”

Read the decision below:

Clarification: An earlier version of this story was headlined “Judge to SEC: This ICO Isn't a Security Offering.” The headline and first sentence have been updated to reflect the fact that the judge found the SEC could not conclusively show that the underlying token was a “security” because of disputed factual issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

4th Circuit Upholds Virginia Law Restricting Online Court Records Access

3 minute read

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute readTrending Stories

- 1Internal Whistleblowing Surged Globally in 2024, so Why Were US Numbers Flat?

- 2In Resolved Lawsuit, Jim Walden Alleged 'Retaliatory' Silencing by X of His Personal Social Media Account

- 3Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

- 4Disney Legal Chief Sees Pay Surge 36%

- 5Legaltech Rundown: Consilio Launches Legal Privilege Review Tool, Luminance Opens North American Offices, and More

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250