Estate Administration and Domicile Issues Raised by Epstein's Suicide

While this case presents interesting issues about the above facts, the issues concerning estate attorneys may be of even more interest.

September 06, 2019 at 02:30 PM

6 minute read

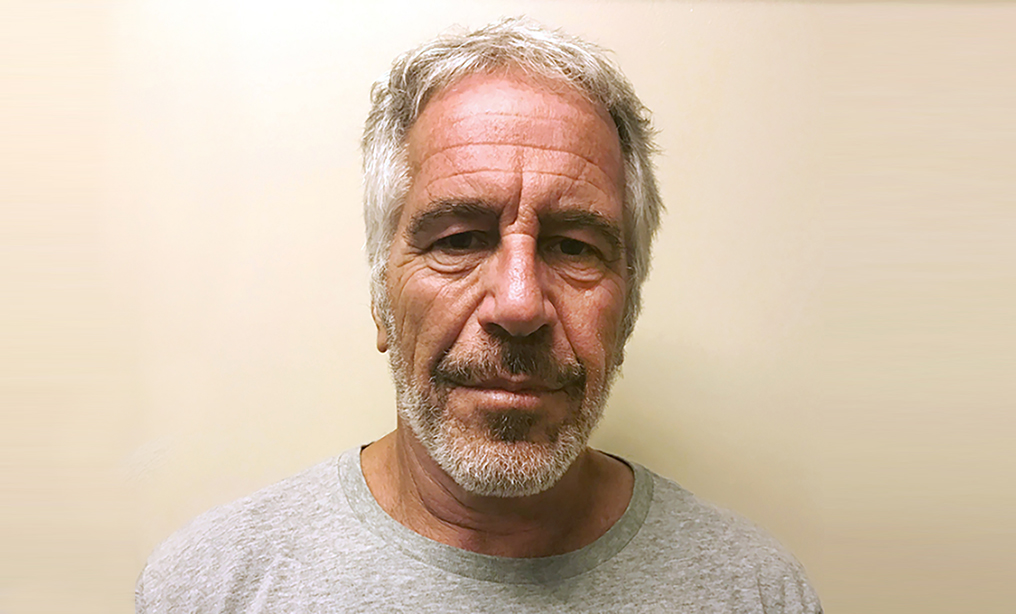

Jeffrey Epstein in 2017. Photo: New York State Sex Offender Registry via AP

Jeffrey Epstein in 2017. Photo: New York State Sex Offender Registry via AP

Recently, the suicide of the financier Jeffrey Epstein whose alleged molestation of underage females transported across state lines has been reported by news outlets on a 24-hour basis. The fact that many rich and famous celebrities and royalty traveled with him allegedly when some of the underage females were present created "news".

Of course, the fact that the suicide occurred while Epstein was incarcerated in New York is scandalous news. Epstein attempted suicide several days before actually succeeding. After his initial attempt he was placed on suicide watch. For some reason as yet unexplained, he was removed from the suicide watch and placed in a cell alone, to be watched by correction officers at least every 30 minutes. Clearly, somewhere along the line, protocols were breached.

While this case presents interesting issues about the above facts, the issues concerning estate attorneys may be of even more interest. There have already been lawsuits filed against Epstein's estate by women alleging damages due to being abused when they were underage. The big question is whether the will and trust executed by Epstein days before his suicide is valid. Where is his domicile? According to reports in the New York Times, other newspapers and TV cable news networks, Epstein had residences in New York, Florida and a privately owned island in the Virgin Islands. Epstein listed his assets as including properties in Paris and New Mexico. He also owned a valuable art collection. Epstein himself valued his estate at approximately $577 million. Where his domicile is determined to be is where the total estate is taxed (less certain adjustments for assets possibly taxed by other states). Other states where Epstein owned homes may be entitled to an estate tax as regards the fair market value of that residence. Typically, personalty is taxed in the state of domicile. Money, stocks and bonds, as well as works of art, would therefore be taxed in the state where Epstein had his domicile. That issue may be litigated in a court in one or more states. Eventually, there would have to be one court in one state with jurisdiction over Epstein's estate. That issue may very well ultimately be decided in the Supreme Court if multiple states make inconsistent decisions.

Epstein's will, supposedly executed days before his death, has been filed in the probate court in the Virgin Islands. Again, according to news reports Epstein "ordered" his representatives to place his assets in the trust. However, if Epstein died before the assets were transferred, there could also be litigation and tax issues. You can be sure that both the Internal Revenue Service and various state taxing authorities will look closely at that issue.

The issues of domicile, the questions as to the validity of will and trust, and where his assets are held are facts of great importance. Where was Epstein's personalty at the time of his death? Was the personalty effectively transferred to the trust before his death? If so, then they are controlled by the trust, if valid. If not effectively transferred before his death, then the personalty will be controlled by his will, also if valid. If the will is found not to be valid, then you end up dealing with an intestate estate.

To review the complexity regarding Epstein's estate we have the following issues:

- Even though Epstein stated in his document executed shortly before his death that the Virgin Islands was his domicile, will courts agree?

- Is the will valid?

- Is the trust valid?

- Were assets supposedly to be titled in the trust appropriately done so before Epstein's death?

- Validity and determination of claims against the estate or possibly the trust?

Based upon what is needed to be discovered about these issues and possibly others, what states benefit from the tax on various assets, and what claimants against his estate may be able to recover are clearly interesting and complex issues to be resolved in the court ultimately found to have jurisdiction over this estate. Another issue that will possibly rear its head is the fraudulent transfer of assets to try to defeat claims of creditors and what state's law controls that issue.

Clearly, the Epstein saga has created a great fact pattern for a final exam question in a law school trusts and estates class. However, of more interest to the legal profession are the current issues as follows:

- Where did the prison system procedures and protocols fail that allowed Epstein to commit suicide?

- For those enjoying conspiracy theories, was there some conspiracy at work here?

- What are Epstein's assets, where are they, and what are their value?

- Was personalty timely placed in Epstein's trust?

- What was Epstein's domicile at death?

- What court or courts will deal with Epstein's estate and trust?

- What states will receive estate taxes, how much will those taxes be, and who will unravel this complex issue that will quite possibly be disputed by several states?

- To what extent will individuals claiming damages from Epstein's estate and trust benefit?

- Will those claiming injury from Epstein many years ago find their claims barred by the statute of limitations?

- Will these claimants seek "forum shopping" to seek possible jurisdictions that will allow claims from years gone by?

Surely, the above list of possible issues and claims may not be complete. I am sure that many attorneys obtaining claimant clients will seek to obtain justice for their clients and damages.

Epstein's issues that existed prior to his suicide and the additional ones raised after his death will certainly keep attorneys and courts busy for quite some time.

Terence E. Smolev is counsel to Berkman Henoch Peterson Peddy and Fenchel in Garden City, New York. This article considers details available as of Sept. 3, 2019.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250