Lawyers Trade Jabs Over Who Should Lead Tezos ICO Class Actions

A hearing over who should take the reins in a ground-breaking securities class action descended into a back-and-forth over missteps by one group of attorneys.

March 15, 2018 at 06:57 PM

4 minute read

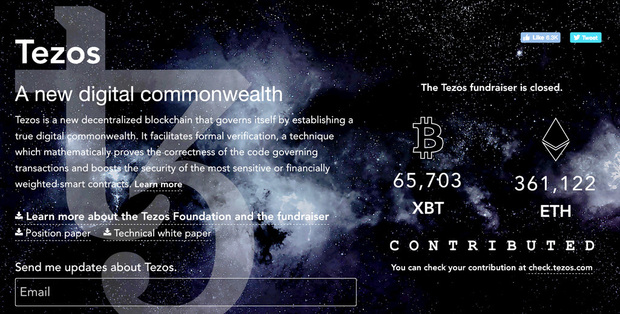

SAN FRANCISCO — Five groups of plaintiffs lawyers on Thursday jockeyed to lead a proposed investor class action against Tezos, which raised some $232 million in cryptocurrency last year in an initial coin offering (ICO) but has still yet to launch its promised blockchain network.

The various entities behind Tezos, including the California-based Dynamic Ledger Solutions and the Tezos Foundation in Switzerland, face a slew of class actions filed last autumn alleging that they sold unregistered securities. The suits seek to allow investors to have their “Tezzies” tokens refunded; a bid to freeze the project's assets fell flat last year.

Despite initial urging from U.S. District Judge Richard Seeborg of the Northern District of California for plaintiffs attorneys to avoid criticizing each other, the hearing on Thursday quickly descended into a back-and-forth over whether one of the groups vying to lead the case had shown themselves to be incompetent.

The group on the defensive, led by Enoch Liang of LTL Attorneys in South San Francisco and Hung Ta of New York-based Hung G. Ta Esq. PLLC, represent the investor with the largest financial stake in the case so far—Arman Anvari, a former Perkins Coie associate in Chicago who says he poured $264,007.50 worth of Ether into Tezos.

That would normally land Anvari the role of lead plaintiff, and his lawyers the job of lead plaintiff's counsel, under the Private Securities Litigation Reform Act (PSLRA). But the lawyers faced criticism over the fact that they missed a filing deadline to lead the class actions, and initially filed their motion in the wrong docket.

Ta downplayed those mistakes, and said the criticism was being leveled by bigger securities firms simply trying to defend their turf. “The opposing counsel clearly resent that someone different … stands to be lead plaintiff,” he said. Ta also called some of the other firms' grouping together of plaintiffs “a sham” and “an end-run around the PSLRA.”

Danielle Myers of Robbins Geller Rudman & Dowd, meanwhile, argued that handing over the case to a firm that made “basic” errors would hurt the representation of the proposed class. “Can you imagine what the defense team will do when they get a crack at it?” she told Seeborg. “That's I think the concern your hearing from the rest of the class.”

“If you're being charged with a case that's the first of its kind,” Myers added, “you should not bungle it out of the gate.” Tezos was the first blockchain company to be hit with civil claims alleging that it issued unregistered securities.

Seeborg, however, seemed reluctant to kick Anvari's lawyers out of the running over the missteps. “In the grand scheme of lawyers making mistakes, that's a pretty small one,” the judge said. “I see a lot worse pretty regularly. ”

San Diego plaintiffs lawyer William Restis, who is representing another group of investors but voiced support for Anvari to lead the class, underscored that being an experienced securities lawyer may not be a leg up in the Tezos case. “

There is no 'wise old man' in the cryptocurrency world, and this is not a typical [securities] action.”

Also vying for the position of lead plaintiffs counsel are the firms Block & Leviton, representing an Australian company called Trigon Trading, and Levi & Korsinsky, representing several plaintiffs calling themselves the “Tezos Investor Group.” Hagens Berman Sobol Shapiro also has a case brought under California state law, which the judge said he was inclined to consolidate with the other federal-law cases.

Joel Fleming of Block & Leviton rejected arguments by some of the other attorneys that Trigon should not be lead plaintiff because, as a foreign entity, it is likely to face jurisdictional challenges. He argued that because Dynamic Ledger Solutions is headquartered in California, the issuance of the tokens took place in the United States, meaning that even a foreign company like Trigon can still sue in U.S. federal court.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Latham Adds Former Treasury Department Lawyer for Cross-Border Deal Guidance

2 minute read

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Trending Stories

- 1Public Notices/Calendars

- 2Wednesday Newspaper

- 3Decision of the Day: Qui Tam Relators Do Not Plausibly Claim Firm Avoided Tax Obligations Through Visa Applications, Circuit Finds

- 4Judicial Ethics Opinion 24-116

- 5Big Law Firms Sheppard Mullin, Morgan Lewis and Baker Botts Add Partners in Houston

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250