Page 183 - ALMExperts 2025 Southwestern Directory

P. 183

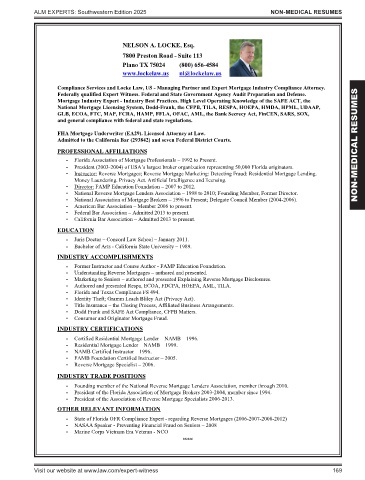

ALM EXPERTS: Southwestern Edition 2025 NON-MEDICAL RESUMES

NELSON A. LOCKE, Esq.

7800 Preston Road - Suite 113

Plano TX 75024 (800) 656-4584

www.lockelaw.us [email protected]

Compliance Services and Locke Law, US - Managing Partner and Expert Mortgage Industry Compliance Attorney.

Federally qualified Expert Witness. Federal and State Government Agency Audit Preparation and Defense.

Mortgage Industry Expert - Industry Best Practices. High Level Operating Knowledge of the SAFE ACT, the

National Mortgage Licensing System, Dodd-Frank, the CFPB, TILA, RESPA, HOEPA, HMDA, HPML, UDAAP,

GLB, ECOA, FTC, MAP, FCRA, HAMP, FFLA, OFAC, AML, the Bank Secrecy Act, FinCEN, SARS, SOX,

and general compliance with federal and state regulations.

FHA Mortgage Underwriter (EA29). Licensed Attorney at Law.

Admitted to the California Bar (293842) and seven Federal District Courts.

PROFESSIONAL AFFILIATIONS NON-MEDICAL RESUMES

Florida Association of Mortgage Professionals – 1992 to Present.

President (2003-2004) of USA’s largest broker organization representing 50,000 Florida originators.

Instructor: Reverse Mortgages; Reverse Mortgage Marketing: Detecting Fraud: Residential Mortgage Lending.

Money Laundering. Privacy Act. Artificial Intelligence and licensing.

Director: FAMP Education Foundation – 2007 to 2012.

National Reverse Mortgage Lenders Association – 1998 to 2010; Founding Member, Former Director.

National Association of Mortgage Brokers – 1996 to Present; Delegate Council Member (2004-2006).

American Bar Association – Member 2006 to present.

Federal Bar Association – Admitted 2013 to present.

California Bar Association – Admitted 2013 to present.

EDUCATION

Juris Doctor – Concord Law School – January 2011.

Bachelor of Arts - California State University – 1989.

INDUSTRY ACCOMPLISHMENTS

Former Instructor and Course Author - FAMP Education Foundation.

Understanding Reverse Mortgages – authored and presented.

Marketing to Seniors – authored and presented Explaining Reverse Mortgage Disclosures.

Authored and presented Respa, ECOA, FDCPA, HOEPA, AML, TILA.

Florida and Texas Compliance FS 494.

Identity Theft; Gramm Leach Bliley Act (Privacy Act).

Title Insurance – the Closing Process, Affiliated Business Arrangements.

Dodd Frank and SAFE Act Compliance, CFPB Matters.

Consumer and Originator Mortgage Fraud.

INDUSTRY CERTIFICATIONS

Certified Residential Mortgage Lender – NAMB – 1996.

Residential Mortgage Lender – NAMB – 1999.

NAMB Certified Instructor – 1996.

FAMB Foundation Certified Instructor – 2005.

Reverse Mortgage Specialist – 2006.

INDUSTRY TRADE POSITIONS

Founding member of the National Reverse Mortgage Lenders Association, member through 2010.

President of the Florida Association of Mortgage Brokers 2003-2004, member since 1994.

President of the Association of Reverse Mortgage Specialists 2006-2013.

OTHER RELEVANT INFORMATION

State of Florida OFR Compliance Expert - regarding Reverse Mortgages (2006-2007-2008-2012)

NASAA Speaker - Preventing Financial Fraud on Seniors – 2008

Marine Corps Vietnam Era Veteran - NCO

032124

Visit our website at www .law .com/expert-witness 169